Weird Stuff Wins: The New AI Strategy Playbook

What are the second order effects of the death of product moats?

Happy Sunday and welcome to Investing in AI. Over on our corporate blog I wrote a new post some of you may like. I spent 3 days reading 200 research paper abstracts on “test time compute”, to get an idea for where the market is, and is going. The post summarizes the most interesting papers and trends. Hope you will check it out.

Today I want to expand on this excellent post by Amanda Robson on the death of product moats in AI. Amanda points out:

When I started venture investing ~10 years ago, we talked a lot about intellectual property. At the time, IP = defensibility and was part of almost every new company assessment.

But what is IP in the age of AI?

It’s hard to imagine that agents won’t continue to take on more of our work. Does the human conductor have rights to the AI’s creation? Will we focus on the data used to create agents instead?

Even today, the training data argument feels weak. Despite copyright lawsuits, ChatGPT has 500M weekly users. And pre-training may no longer matter as the internet - the most significant digital data source we have - has already been plugged into today’s models.

Apart from IP, many functions will fundamentally change. Products - and entire operations - may not be needed in the future.

Will learning & development departments exist when employees can learn everything just-in-time? Will agents market and sell to one another, eliminating humans? Will security become agent attackers vs. agent defenders?

The pace of change is challenging everything. And what can be considered a true “moat” has also fundamentally changed.

She highlights a few ideas for future moats, but I want to highlight one more that I think will happen - weirdness. What I mean by weirdness is ideas that aren’t’ popular or common. Let me explain with an example from Texas Hold’em.

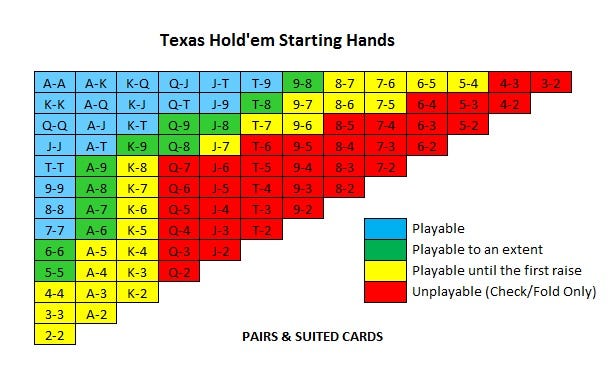

In Texas Hold’em, you are dealt 2 cards face down, often called your “pocket” cards. Other players can’t see them. And you have to decide if you want to bet, or stay in the pot, to see what other cards are dealt. The chart below shows common recommendations for whether to play each hand.

But the red hands aren’t un-winnable, they are just unlikely. If you are dealt 6-2, the probability of winning is very low. But if you decide to always play that hand, sometimes you will win. You will hit three 6s or maybe a straight.

This is important because modern LLM based AI deals in probabilities. When Amanda, and others, point out that AI will be running things for us, you have to remember those AIs won’t be 100% correct. They will play the probabilities.

What does that mean for investments in AI?

Well, just as most poker players who play 6-2 pocket cards will lose, most startups that place low probability bets will lose. But the startups that win, like the poker players who stick with 6-2 and hit a straight, will seem brilliant.

Your best bet as an entrepreneur and investor might be to play low probability strategies and hope you hit the unlikely outcome. Or focus on areas where the AI models may have inaccurate or incomplete data distributions. You might have to bet on 6-2.

In a world where your only chance of winning may be to play low probability strategies and the few big winners that happen have adopted that strategy, you will start to see very different investor behavior. Over time the weirdest most out-of-distribution stuff will get funded.

Entrepreneurs have complained for a long time that VCs don’t really fund innovative ideas, but prefer obvious marginal innovation kinds of things. That has worked ok because those companies get picked up at small exit multiples by big players, and, occasionally they do turn into big companies on their own.

As AI makes all the marginal innovation easy and obvious and taken by the existing players, the success distribution might shift to the weird ideas. If it does, VCs will follow. And then maybe we really get the world entrepreneurs want - the one where the weirdest and craziest stuff gets funded.

I don’t know what the future holds and I am actually a bit of a skeptic on the near term limits of AI, so I think this future may be farther away than most believe. But it’s a real possibility in a world where AI agents are successful and drive the way we work.

Thanks for reading.

I like the concept of weird.

To clarify my own understanding, this perspective is reinforced by the concept of information asymmetry. While AI excels at analyzing structured data, human entrepreneurs and investors can leverage unique insights and navigate situations where information is scarce, ambiguous, or held privately.

These are precisely the conditions often found in low-probability, high-potential ventures that lie outside the reach of current AI models.

I'm curious which investors will leverage this strength of humans in this scenario.