Happy Sunday and welcome to Investing in AI! I’m Rob May, cofounder of the AI Innovator’s Community in Boston and NYC. If you are New York based and want to come to our September entrepreneur and executive dinner email me for the link.

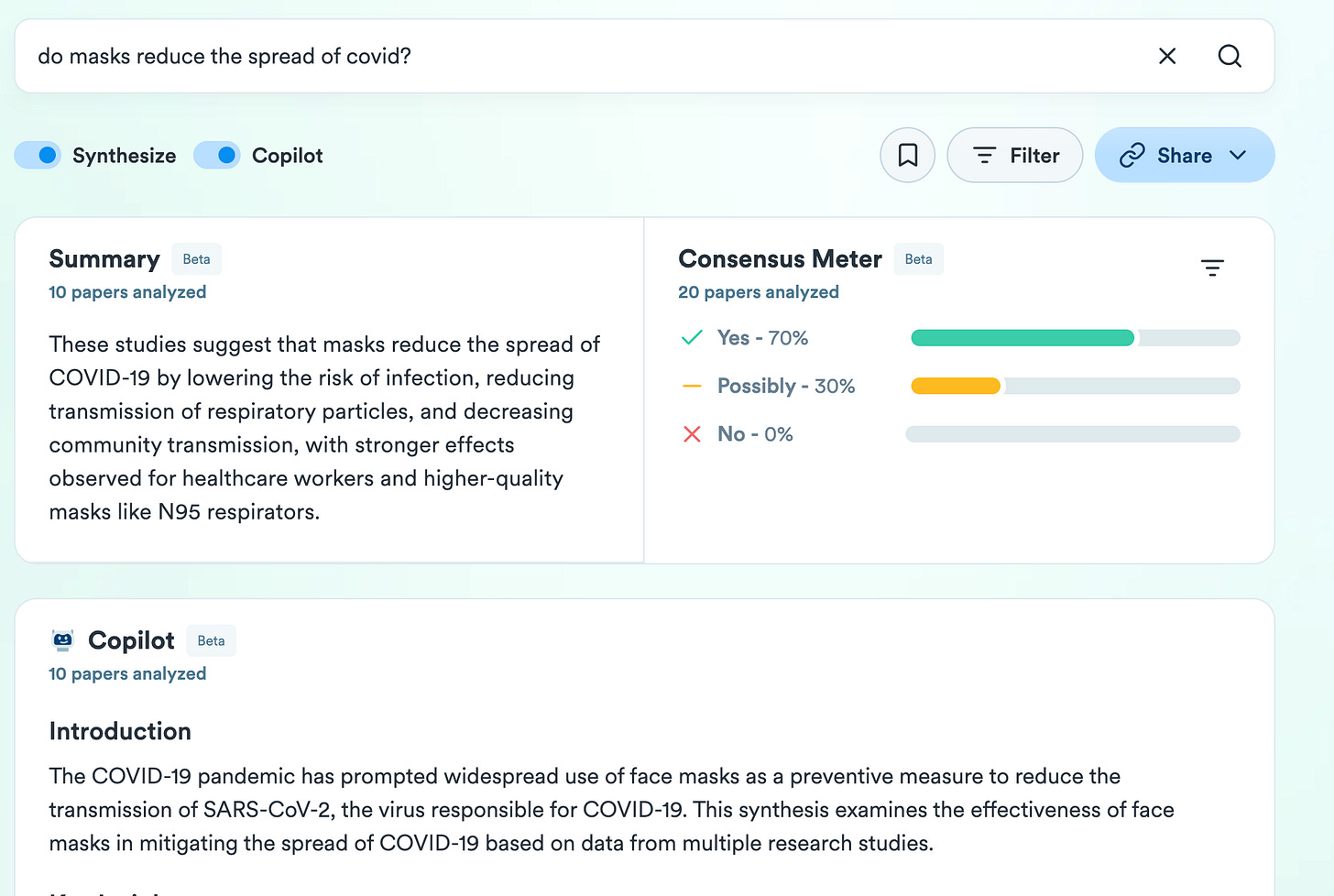

Union Square Ventures recently led the Series A round of Consensus, a company I was fortunate to invest in almost two years ago. Consensus is a tool that uses natural language search to return results for studies and research papers. For example, you can ask Consensus “do masks reduce the spread of covid” and the app will return the top research papers on that, and some metrics over what the papers say and if there is a consensus, as seen below:

USV had a thesis on “the fragmentation of search.” I won’t go into it because you can read it in their blog post referenced above. It’s a good thesis that I largely agree with but, that isn’t why I made the investment.

My thesis was built more around the idea that AI is going to level the playing field for companies of all kinds in many ways. I believe it will narrow the gap between the best and worst performers in most fields, particularly in core operational areas, because so many operational tasks will be offloaded to software. Now, as that happens, it means it will be even easier to start a company, and for existing companies to enter new markets. It means more fragmentation. And it means more companies competing for your attention.

But…

There is one thing that doesn’t increase in the world of AI… our capacity for attention. When everything else in an economic equation scales up and becomes more efficient except one thing… you know that one thing becomes incredibly valuable. And thus, one of my biggest theses about AI is that it will lead to a dramatic increase in the value of attention.

What does that mean for investing? It means that the indirect impact of AI is that great customer acquisition execution goes up in value. Maybe it seems a little counterintuitive, but, I evaluate AI companies by looking for unique customer acquisition attributes. The indirect impact of AI is that those have become more valuable.

What does that mean for Consensus? Well, they had two things going for them on the customer acquisition side.

Their product encourages sharing. When you look up some research you often share it with your team, or often even publicly via social media, or in a lecture.

The target market is academics, who are under-targeted by startups compared to say, VPs of Sales or CFOs or whoever. So, their is more slack in their attention stack to tap into, and reaching them is cheaper than reaching most corporate exec customers.

The result is that customer acquisition for Consensus was incredibly efficient, and in ways that seem likely to scale well, compared to most other businesses that I’ve seen. That was what drove me to make the investment in the Seed round - it was an indirect impact of AI.

VCs say a lot of things that used to make sense but don’t anymore. They love to say “sell to sales - the closer to revenue you are the more valuable you are.” But they forget that after saying that to every startup for 20 years you now have heads of sales bombarded and overwhelmed with marketing messages and it’s difficult to break through. And AI is going to accelerate that problem.

So where to invest in an AI world? Invest in the things that AI can’t change. Invest in uniquely efficient customer acquisition models, because all the people playing the standard customer acquisition game will have perpetually worsening business models.

Thanks for reading.