Happy Sunday and welcome to Investing in AI! If you haven’t followed our AI Innovator’s Podcast yet, check out the latest episode here.

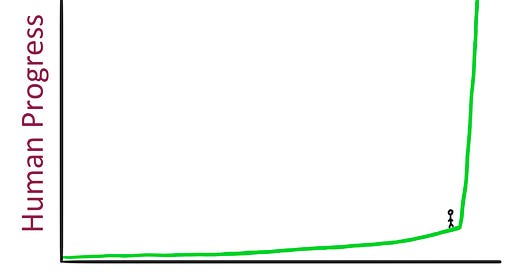

Today I want to talk about a very popular old blog post on AI. In 2015, Tim Urban from “Wait But Why” published this piece on AI. It contained this famous chart, which I used a few times in presentations a few times in the following years.

From 2015, when I started focusing on AI, until about 2022, I was pretty convinced, as was most of the AI world, that first mover advantage in AI would matter more than in other markets. Why? Because AI was about to explode. And because of the data advantage flywheel. AI was all about the data, and data was the competitive advantage. The more you got earlier, the harder it was for people to compete later. But as Yogi Berra (supposedly) said “It’s difficult to make predictions, especially about the future.”

It’s important to constantly re-evaluate theses as an investor and adapt to the truths we are learning from the market. It’s also why as much as I am a conviction based investor, that conviction is always rooted in probabilities.

So far, it doesn’t appear that first mover advantage matters as much as I thought. Why is that? In retrospect, I think there are three reasons.

New model architectures can still change the game quite a bit. When Urban’s post was written in 2015, Transformer architectures, the now dominant form of AI architectures, had not been invented. Whatever data you have, a new breakthrough model that allows you to train faster or use less data will always provide another path to success.

ROI hasn’t always been there. I think we as techies were naive to assume that people would adopt AI just because it was AI. That’s not how businesses work. Sequoia even wrote about this a while back in AI’s $600 billion dollar question. As a startup, when you can’t get adoption because your customer isn’t seeing the ROI, competitors have time to catch up no matter how early your start, because without usage you haven’t really built a flywheel.

The final reason is that fast following has become the norm in AI. Anytime a new model is released, an open source version of comparable quality trained on similar data follows within a few months.

It’s not to say there aren’t AI companies with proprietary data sets, or for whom first mover advantages matters. There are. In fact, pretty much any rule I could give you about business has exceptions in a few companies. There are no absolutes. But there haven’t been as many defendable first mover advantages as I expected, and I think I leaned into that too much in my early AI investing.

Thankfully, early stage investing is one of the few markets where you can be wrong 80% of the time and still do well if your winner go big enough.

What does this mean for my theses going forward? I’m looking much more at fast follower companies. I’m spending more time evaluating whether supposedly defensible data sets really are defensible. I’m factoring into my probabilities that new model architectures and other innovations could weaken the value of proprietary data.

It’s not about being first to do it. It’s about being the first to do it when the market is ready. It turns out AI isn’t so different than the technologies that came before it.

Thanks for reading.

This article is old, but really good and I think has held the test of time on when first-mover advantage works. https://hbr.org/2005/04/the-half-truth-of-first-mover-advantage

AI has a very high rate of technological change and very fast market evolution - those are the conditions that leads to the least first-mover advantage.

It seems like investors and startups have underestimated the speed at which enterprises will integrate ai into their operations. (I have zero insight into the consumer side.)